Today’s guest blogger is Mark Arrow. Mark is the CEO/President of Headcount Management. Besides being an NPAworldwide vendor, speaker and staffing industry advocate, Headcount currently services multiple NPA clients. Headcount is a leader in back-office solutions designed specifically for staffing agencies.

Today’s guest blogger is Mark Arrow. Mark is the CEO/President of Headcount Management. Besides being an NPAworldwide vendor, speaker and staffing industry advocate, Headcount currently services multiple NPA clients. Headcount is a leader in back-office solutions designed specifically for staffing agencies.

Headcount makes doing staffing deals (also known as: contract, temp, contingent) simple for NPAworldwide members. Essentially, once candidates are placed, Headcount will professionally onboard, insure and payroll employees. Headcount also invoices clients (with your agency’s branding), accounts for all monies, provides detailed KPI’s and profit reports…and of course, profits. The Back Office, their newest initiative, is the industry’s easiest way for agencies to produce weekly payroll, invoices, and profit reporting via agency insurance and funding.

Since 2008, Headcount has helped staffing firms across all 50 states mitigate liability, reduce costs, and maintain full hiring compliance. Here are some testimonials.

The IRS reports that as many as 33% of businesses make payroll mistakes each year. When it comes to staffing agency payroll, the importance of properly paying employee wages on time and without error is paramount to guaranteeing employee satisfaction.

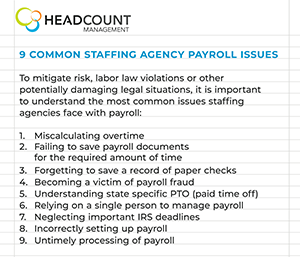

To mitigate risk, labor law violations or other potentially damaging legal situations, it is important to understand the most common issues staffing agencies face with payroll:

- Miscalculating overtime

- Failing to save payroll documents for the required amount of time

- Forgetting to save a record of paper checks

- Becoming a victim of payroll fraud

- Understanding state specific PTO (paid time off)

- Relying on a single person to manage payroll

- Neglecting important IRS deadlines

- Incorrectly setting up payroll

- Untimely processing of payroll

The pattern should be clear. Proper processing of staffing agency payroll can reduce your exposure by a third.

Record Everything

Adequately managing payroll, for any sized business, relies heavily on meticulous record keeping. Documentation of paper and electronic records, and maintaining records longer than you may be expected to are all important ways to avoid payroll problems. It is highly recommended that you keep records for at least 3 years. This includes all I-9s, W-4s, timesheets, and payroll files (tax forms, pay stubs, etc.).

Know Your Overtime Laws

If you’re at all unclear about the rules for paying overtime in your specific geography, contact the Department of Labor or use their overtime calculator to determine the correct compensation.

Don’t Rely on a Single Person to Manage Staffing Agency Payroll

Dispersing payroll to multiple employees or outsourcing payroll to a professional team can help you avoid payroll fraud and miscalculations. By dividing responsibilities, it is easier to identify fraudulent payroll scenarios. It is far less likely that a deadline will be overlooked with more than one set of eyes monitoring timely processing.

Keep a Detailed Calendar

Even if you are working with a professional payroll management team, keeping your own detailed calendar of federal, state, county, and municipal tax and filing deadlines is one of the easiest (and free) ways to make sure every single deadline is met, every time.

Have a Plan for Terminations

When an agency separates from an employee, regardless of the reason, it is important to manage final pay and comply with labor laws for payroll appropriately. Failure to do so can result in litigation.

Find a Staffing Agency Payroll Solution That Works for You!

Even with all of these solutions in mind, payroll remains one of the most difficult aspects of running a business. If you’re still struggling to get your questions answered, Headcount Management is here to help you manage payroll effectively. Get in touch today to understand the difference an outsourced professional payroll team can make.