Today’s guest blogger is Michele Medley. She manages all client engagement for Headcount Management, a global leader in back-office solutions for staffing agencies. Services include Employer of Record (EOR), Agent of Record (AOR), IC compliance, payroll funding/processing, workforce deployment, global expansion, administrative outsourcing, workers compensation, GL insurance, HR support, risk management, and more. Headcount has been helping recruiters and staffing firms make contract hires since 2008 in all 50 states.

Today’s guest blogger is Michele Medley. She manages all client engagement for Headcount Management, a global leader in back-office solutions for staffing agencies. Services include Employer of Record (EOR), Agent of Record (AOR), IC compliance, payroll funding/processing, workforce deployment, global expansion, administrative outsourcing, workers compensation, GL insurance, HR support, risk management, and more. Headcount has been helping recruiters and staffing firms make contract hires since 2008 in all 50 states.

Successful staffing agencies have a keen understanding of the costs and other factors that impact their bill rates.

There isn’t a template or simple rubric for pricing your staffing business. That’s because there are many factors to consider when calculating the profit you will expect to earn from a job placement. Although this guide doesn’t cover every factor for calculating net profit that may be relevant to your specific staffing agency, we do cover the primary elements you need to understand.

By understanding the important components below, you will have a better understanding of the status of your business and how you can adjust the staffing markup to achieve better profit margins.

Components for Calculating Staffing Agency Net Profit

Bill Rate

The bill rate is the amount per hour that you charge clients. Your bill rate includes your staffing agency markup.

The average staffing agency markup for temporary employees can range anywhere between 20 – 75%. Permanent placement markups are typically 10 – 20% of the employee’s gross annual salary.

It’s important to note that staffing agency markups vary based on several factors including competition, client relationships, industry, and the local market.

Pay Rate

The pay rate is the amount per hour that you pay your employees. The majority of your bill rate goes to your employee’s wages.

Payroll Burden

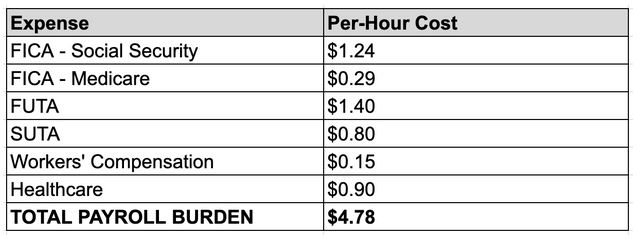

Payroll burden includes the regulatory and benefits costs associated with each employee. Since payroll burden is impacted by various factors like current federal regulation and location, below are the most common costs in the United States.

FICA Taxes

The Federal Insurance Contributions Act (FICA) funds Social Security and Medicare through payroll taxes on both employers and employees. FICA taxes apply nearly across the board to all employees.

The current FICA withholding rate for employers is 7.65%. 6.2% on earnings up to $117,000 goes to Social Security and 1.45% (with no cap) goes to Medicare.

Federal & State Unemployment Insurance Taxes

Unemployment insurance is paid by the state and federal government to employees who lost their job through no fault of their own. Employer-paid unemployment insurance taxes fund these safety net programs.

The federal unemployment insurance tax (FUTA) rate is a standard 6% of the employee’s earnings up to $7,000 for employers.

The state unemployment insurance tax (SUTA) rate varies by state. It’s also based on your Unemployment Insurance Experience Rating, which is the likelihood that you will lay off staff.

Workers’ Compensation Insurance

Workers’ compensation insurance provides cash payments to employees who suffer on-the-job injuries for medical treatments and lost wages. Your workers’ compensation insurance rate depends on several factors including which state you’re in, employee classification code (type of work), and your company’s history of workplace injuries.

Employers pay their workers’ compensation premiums per $100 of payroll. Lower risk jobs like clerical/administrative work are charged lower rates than higher risk jobs like construction or manufacturing. For example, an employer could be charged $0.15 per $100 of taxable wages paid to an administrative assistant as the workers’ compensation insurance premium for that employee.

Healthcare

The Affordable Care Act mandates employers with over 50 employees to provide health insurance benefits. State and local jurisdictions may have additional healthcare or sick leave requirements.

Your healthcare costs will depend on your location, the type(s) of health insurance you offer, and what your employees choose.

Additional State & Local Taxes

Depending on your location, you may be required to pay state, county, municipality, or regional taxes.

Miscellaneous / Discretionary Costs

These are additional costs associated with hiring and employing someone including background checks, 401(K) contributions, transit passes, parental leave, etc.

Example – Calculating Staffing Agency Profit

In this example, a staffing agency is placing an administrative assistant earning $20 per hour. The per-hour payroll burden costs are calculated in the table below. Remember that there are a variety of factors that can impact your payroll burden costs including work location.

Table 1. Calculate Payroll Burden

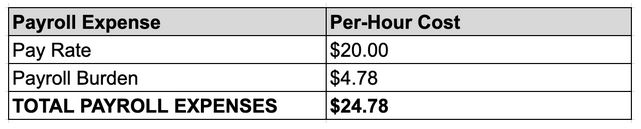

Table 2. Calculate Cost of Payroll

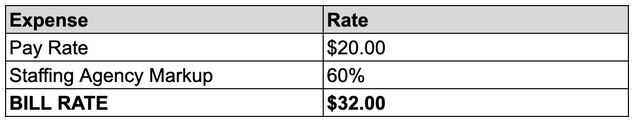

Table 3. Calculate Bill Rate

This is where you will add your staffing agency markup to your pay rate.

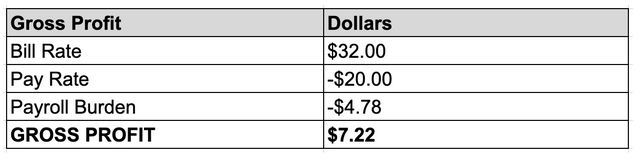

Table 4. Calculate Gross Profit

Read our guide on how to use our FREE Gross Profit Margin Calculator for Staffing Agencies.

Table 5. Calculate Net Profit

Net profit is the overall profit your staffing agency will make after you pay for your operating costs. These costs include your wages, office space, marketing, insurance, and other expenses to run the business.

In this example, your operating costs are broken down to $3.00 per hour, per employee.

Calculate Your Gross Profit Margin

Download our Gross Profit Margin Calculator to take control of your staffing agency’s pricing strategy and remain competitive in the changing marketplace. Have questions? Schedule A Free Consultation with one of our staffing experts.